The 2-Minute Rule for Best Investment Books

Wiki Article

The most effective Investment decision Books

Facts About Best Investment Books Revealed

Considering getting a better Trader? There are various guides that can help. Thriving investors go through extensively to acquire their skills and continue to be abreast of emerging methods for expenditure.

Considering getting a better Trader? There are various guides that can help. Thriving investors go through extensively to acquire their skills and continue to be abreast of emerging methods for expenditure.Benjamin Graham's The Intelligent Trader is an indispensable manual for just about any investor. It covers anything from essential investing procedures and risk mitigation strategies, to value investing techniques and strategies.

1. The Small Reserve of Widespread Sense Investing by Peter Lynch

Created in 1949, this typical do the job advocates the worth of investing that has a margin of security and preferring undervalued shares. Essential-go through for anyone thinking about investing, particularly All those hunting over and above index funds to identify particular high-benefit prolonged-phrase investments. Furthermore, it covers diversification principles and also how to avoid currently being mislead by sector fluctuations or other investor traps.

This book supplies an in-depth guide on how to develop into An effective trader, outlining all of the principles each individual trader really should know. Topics reviewed inside the e book range between market place psychology and paper trading techniques, staying away from typical pitfalls which include overtrading or speculation and even more - earning this e-book vital reading for significant traders who want to be certain they possess an in-depth familiarity with elementary trading ideas.

Bogle wrote this extensive e book in 1999 to drop gentle within the hidden fees that exist inside of mutual money and why most traders would benefit much more from purchasing lower-payment index resources. His advice of saving for rainy working day funds even though not inserting all of your eggs into just one basket together with investing in inexpensive index funds continues to be legitimate these days as it was back then.

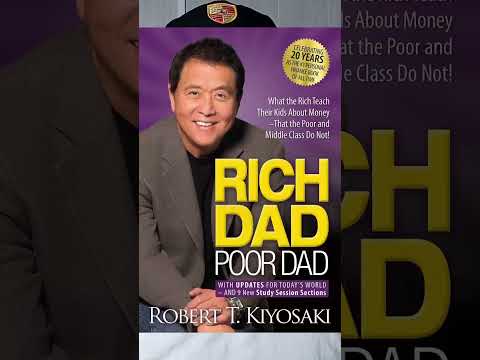

Robert Kiyosaki has lengthy championed the importance of diversifying money streams through real estate and dividend investments, particularly housing and dividends. Though Loaded Father Bad Father may perhaps tumble more into personal finance than individual improvement, Prosperous Dad Inadequate Dad remains an educational examine for any person wishing to higher comprehend compound interest and the way to make their funds work for them in lieu of in opposition to them.

For a thing much more present-day, JL Collins' 2019 ebook can provide some Substantially-desired point of view. Meant to tackle the needs of financial independence/retire early communities (Fireplace), it focuses on achieving monetary independence by frugal dwelling, affordable index investing and also the four% rule - as well as ways to lessen student financial loans, spend money on ESG assets and take advantage of on the internet investment sources.

two. The Minor Reserve of Stock Industry Investing by Benjamin Graham

What Does Best Investment Books Mean?

Thinking about investing but Doubtful how to commence? This e-book provides sensible guidance prepared especially with youthful buyers in mind, from considerable university student financial loan credit card debt and aligning investments with individual values, to ESG investing and on line economic resources.

Thinking about investing but Doubtful how to commence? This e-book provides sensible guidance prepared especially with youthful buyers in mind, from considerable university student financial loan credit card debt and aligning investments with individual values, to ESG investing and on line economic resources.This most effective financial commitment e-book exhibits you how to detect undervalued shares and create a portfolio that should supply a continuous source of money. Employing an analogy from grocery purchasing, this ideal guide discusses why it is much more prudent not to center on highly-priced, perfectly-marketed merchandise but alternatively focus on minimal-priced, missed types at gross sales rates. Furthermore, diversification, margin of security, and prioritizing worth around progress are all talked over thoroughly in the course of.

A basic in its field, this ebook explores the fundamentals of benefit investing and how to establish possibilities. Drawing on his expenditure enterprise Gotham Funds which averaged an yearly return of forty % during twenty years. He emphasizes avoiding fads whilst getting undervalued corporations with powerful earnings prospective buyers and disregarding short-phrase industry fluctuations as significant ideas of productive investing.

This finest investment book's author provides read more advice for new investors to avoid the errors most novices make and optimize the return on their own dollars. With action-by-action Guidelines on making a portfolio intended to steadily increase after a while plus the author highlighting why index resources provide quite possibly the most economical suggests of investment, it teaches audience how to keep up their strategy regardless of sector fluctuations.

Even though initial posted in 1923, this e book stays an priceless guidebook for anyone keen on controlling their finances and investing correctly. It chronicles Jesse Livermore's have a peek at this web-site experiences - who earned and shed thousands and thousands above his life time - whilst highlighting the importance of likelihood theory as Component of final decision-producing processes.

For anyone who is searching for to enhance your investing skills, you will discover many terrific publications out there that you should decide on. But with restricted several hours in every day and confined readily available studying substance, prioritizing only Individuals insights which supply essentially the most benefit might be challenging - And that's why the Blinkist app offers these kinds of easy access. By accumulating important insights from nonfiction guides into bite-sized explainers.

three. The Little E book of Value Investing by Robert Kiyosaki

This ebook addresses buying organizations by having an economic moat - or aggressive edge - including an financial moat. The author describes what an economic moat is and provides samples of some of get more info the most renowned companies with a person. In addition, this ebook aspects how to determine a firm's benefit and buy stocks In keeping with price-earnings ratio - ideal for rookie buyers or anyone eager to master the fundamentals of investing.

This doorstop financial commitment book is each well-liked and detailed. It covers most of the best practices of investing, which include beginning young, diversifying extensively and never spending superior broker fees. Created in an engaging "kick up your butt" design which can either endear it to readers or change you off absolutely; though masking quite a few popular pieces of advice (commit early when others are greedy; be wary when Other people grow to be overexuberant), this text also suggests an indexing approach which seriously emphasizes bonds in comparison with many similar procedures.

Best Investment Books Things To Know Before You Buy

This ebook provides an insightful method for stock picking. The creator describes how to pick winning stocks by classifying them into 6 unique groups - gradual growers, stalwarts, rapid growers, cyclical shares, turnarounds and asset plays. By following this straightforward program you improve your odds of beating the industry.

This ebook provides an insightful method for stock picking. The creator describes how to pick winning stocks by classifying them into 6 unique groups - gradual growers, stalwarts, rapid growers, cyclical shares, turnarounds and asset plays. By following this straightforward program you improve your odds of beating the industry.Peter Lynch is without doubt one of the earth's Leading fund administrators, obtaining operate Fidelity's Magellan Fund for 13 decades with a mean return that conquer the S&P Index each and every year. Printed in 2000, his book highlights Lynch's philosophy for choosing stocks for individual buyers in an obtainable way that stands in stark contrast to Wall Avenue's arrogant and extremely specialized approach.

Warren Buffett, among the list of richest Guys on the planet, has an uncanny ability to Assume logically. This e-book, at first prepared as letters to his daughter, consists of sensible and clever guidance on earning the stock sector work for you - with its most famed tip currently being shopping for undervalued assets for a lot more than their intrinsic value - furnishing newcomers to investing with a great foundation in investing and seasoned kinds with useful recommendations to really make it lucrative. This really is among the finest books to Keep reading investing.

4. The Minor E book of Inventory Marketplace Buying and selling by Mathew R. Kratter

If you need to attain inventory market investing experience and extend your own portfolio, this book presents an ideal place to begin. It explains how to choose shares with sturdy progress prospective while training you about examining corporations - and also aiding newcomers prevent widespread problems they frequently make. Also, its apparent and simple language make for a pleasant examining practical experience.

Benjamin Graham is recognized as the father of price investing, an strategy centered on acquiring top quality stocks at small prices. He wrote two guides on investing; Safety Analysis is his signature work describing his conservative, price-oriented tactic - it has even been proposed by prime investors for instance Invoice Ackman and John Griffin!